SEATTLE, WA / ACCESS Newswire / February 14, 2026 / In order to adapt to the continuous evolution of payroll documentation requirements across the United States, many businesses and independent professionals are searching for more reliable and flexible methods for managing their income records. StubCreator is making enhancements to its online paystub creation services in order to help various organizations, freelancers, and independent contractors keep structured and professional payroll documentation.

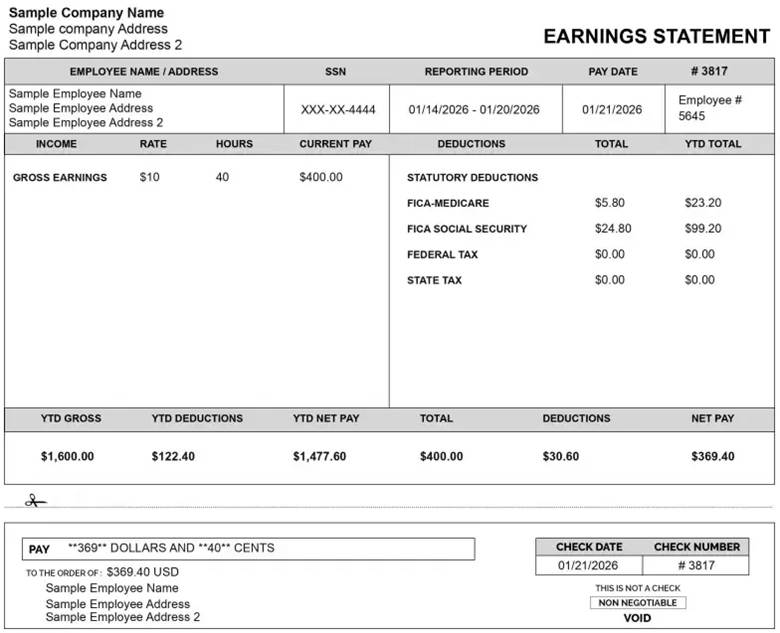

More than 90% of US workers would consider freelancing or independent contracting work. The increasing growth of remote work and the gig economy has created higher demand for flexible income documentation solutions. In order to do that, StubCreator allows small business owners, self-employed individuals, and those who work as independent contractors and freelancers to create professional pay stubs in an easy-to-use digital way. This free paystub generator allows users to complete and generate a full accounting of what is owed to them and document it. Owners or contractors check payroll documents with all aspects of what is owed to each individual, including total earnings, deductions, taxes withheld, and all other year-to-date totals.

The online platform features a diverse selection of paystub template options to support various payment structures of small business owners and independent contractors. Users can choose from standard templates, advanced paystub formats with detailed income breakdowns, and fully customizable paystub options that allow businesses to align payroll documentation with branding and compensation structures.

Types Of Solution Provided By StubCreator To Support Businesses & Independent Contractors

-

Default Paystub Creation

-

Custom Paystub Creation

-

Advanced Paystub Creation

-

Invoice Generation

-

W2 Form Generation

StubCreator supports individuals who require structured income records for:

-

Tax filing,

-

Loan applications,

-

Rental approvals,

-

Financial verification purposes.

Small and mid-sized businesses also benefit from the platform by reducing manual documentation tasks and improving payroll efficiency.

StubCreator allows users to create, download, and manage paystubs securely across multiple devices, providing accessibility while maintaining data confidentiality.

As payroll compliance requirements continue to evolve with the implementation of U.S. tax regulation updates and revised reporting guidelines, StubCreator remains committed to delivering dependable paystub creation solutions that help businesses and independent workers maintain accurate, compliant, and well-documented financial records.

For more information about the paystub creator tool, visit stubcreator.com.

About StubCreator

StubCreator is an online paystub generation service that enables you to generate professional pay stubs in minutes. It is a useful way for independent contractors, such as freelancers or consultants, to show proof of income. You can choose from pre-designed paystub templates like standard, advanced, or make your own preset based on payment styles and documentation requirements. StubCreator specializes in providing accurate automated calculations of federal and state taxes in all 50 states, allowing users to produce compliant pay stubs.

Contact Information

Company: StubCreator

Website: https://stubcreator.com

Email: support@stubcreator.com

Phone: 9737817888

SOURCE: StubCreator

View the original press release on ACCESS Newswire