Board Games Market Size, Consumer Entertainment Trends, and Forecast 2026–2034

PUNE, MAHARASHTRA, INDIA, February 11, 2026 /EINPresswire.com/ — Board Games Market Overview Analysis

The global board games market represents a vibrant and expanding sector at the intersection of social entertainment, family bonding, and cognitive development. This traditional gaming segment encompasses classic titles including Monopoly, Scrabble, and chess, alongside innovative contemporary designs that appeal to diverse age demographics worldwide. As digital fatigue increases and consumers seek meaningful in-person interactions, board games experience renewed cultural relevance and commercial momentum.

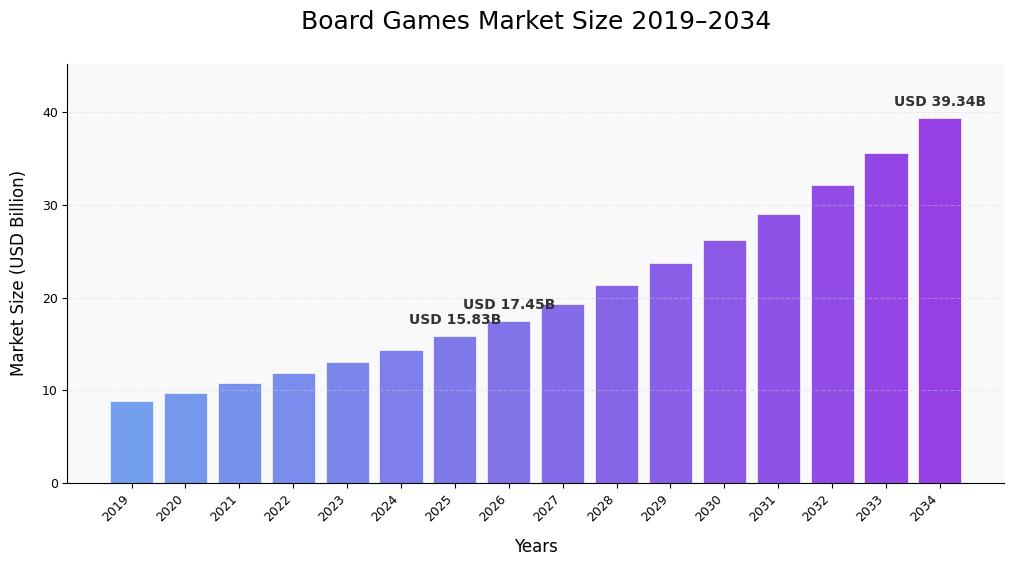

Market Valuation and Growth Projections

The global board games market size was valued at USD 15.83 billion in 2025 and is projected to grow from USD 17.45 billion in 2026 to USD 39.34 billion by 2034, registering a CAGR of 10.70% over the forecast period. North America dominated the board games market with a market share of 42.06% in 2025.

Regional analysis reveals North America commanding market leadership with USD 5.98 billion in 2024, driven by high consumer engagement, sophisticated retail infrastructure, and strong gaming culture. The United States specifically demonstrates exceptional market vitality, projected to reach USD 3.90 billion in 2025, supported by continuous product innovation and franchise collaborations that attract both traditional gamers and new audiences. Europe follows as a significant market contributor, with established gaming traditions and expanding specialty retail presence supporting steady growth across Germany, United Kingdom, and France.

Request a Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/board-games-market-104972

Product Category Leadership and Innovation Trends

Monopoly maintains dominant market position among game types, valued for its universal recognition, simple gameplay mechanics, and extensive availability in themed versions ranging from classic editions to franchise collaborations. The game’s adaptability enables manufacturers to develop specialized editions incorporating popular culture references, regional themes, and licensed properties that expand appeal across demographic segments. Recent product launches including MONOPOLY: One Piece Edition demonstrate ongoing innovation leveraging anime popularity and franchise loyalty.

Chess represents the second-largest game type segment, benefiting from timeless appeal, cognitive development associations, and growing competitive tournament culture. High-profile celebrity endorsements, including Victor Wembanyama’s chess tournament organized in collaboration with Nike, elevate the game’s cultural profile and attract younger demographics. Scrabble and other traditional games maintain substantial market presence through educational value propositions and multigenerational appeal that positions them as family entertainment staples.

Age Group Segmentation and Consumer Behavior

The above 25 years demographic commands the largest market segment with 37.98% share in 2025, reflecting board games’ evolution beyond children’s entertainment into adult leisure activities. This demographic values board games as stress relief tools, social bonding mechanisms, and screen-free entertainment alternatives. Premium strategy games including Brass: Birmingham and Terraforming Mars attract sophisticated adult gamers seeking intellectual challenge and social engagement. The trend of hosting board game nights among millennials demonstrates lifestyle integration that extends beyond occasional family gatherings.

The 12 to 25 years segment represents the second-largest demographic, driven by gaming cafe culture, social media influence, and community events that normalize board gaming among younger adults. Educational institutions, college gaming clubs, and organized tournaments create engagement opportunities that foster lifelong gaming habits. Younger demographics particularly respond to licensed products, themed editions, and games incorporating contemporary popular culture references that align with their entertainment preferences and social identities.

Distribution Channel Evolution and Retail Dynamics

Specialty stores maintain dominant distribution channel position with 42.22% market share in 2024, leveraging dedicated retail environments that provide expert consultation, extensive product selection, and experiential shopping opportunities. These formats include toy stores, dedicated board game shops, and brand flagship locations positioned in high-traffic shopping districts and entertainment centers. The Lego Group’s launch of its first Gurugram, India store exemplifies specialty retail expansion into emerging markets pursuing growth opportunities.

Online and e-commerce channels demonstrate the fastest growth trajectory at 11.53% CAGR through 2032, driven by convenience, extensive product reviews, competitive pricing, and subscription box services. Digital platforms enable niche product discovery, community recommendations, and direct manufacturer-to-consumer relationships that traditional retail cannot match. Social media integration, influencer marketing, and online gaming communities create awareness and drive e-commerce conversions, particularly among digitally native younger consumers seeking convenient purchasing options.

Gaming Community Growth

Board gaming communities constitute powerful market drivers through organized events, social gatherings, and digital platforms that share product recommendations and create engagement opportunities. SPIEL (Essen Game Fair) recorded 204,000 attendees from over 80 countries in 2024, demonstrating international community strength and industry vitality. Such events facilitate product discovery, manufacturer-consumer interaction, and community building that extends beyond individual purchases to lifestyle adoption.

Strategic Partnerships and Franchise Collaborations

Licensing partnerships with popular franchises create significant growth opportunities by leveraging established fan bases and brand loyalty. Goliath Games’ collaboration with The Sims franchise exemplifies strategic approaches tapping into video game properties with loyal followings. These partnerships enable cross-media engagement where consumers familiar with digital properties explore board game adaptations, expanding market reach beyond traditional gaming demographics.

Manufacturers increasingly develop theme-based editions incorporating regional interests, sports franchises, and cultural phenomena that resonate with specific consumer segments. Hasbro India’s cricket-themed Monopoly edition demonstrates localization strategies addressing regional preferences and cultural relevance. Such targeted product development enables market penetration in diverse geographic markets while maintaining core gameplay mechanics that ensure accessibility and brand consistency.

Competitive Landscape and Market Positioning

Industry leadership concentrates among established toy and game manufacturers including Hasbro Inc., Mattel Inc., Asmodee, Ravensburger AG, and Goliath Games, which leverage extensive distribution networks, brand recognition, and production capabilities. These companies pursue growth through acquisition strategies, exemplified by Funskool India’s acquisition of Catan manufacturing rights from Asmodee, enabling portfolio diversification and market expansion into high-growth regions.

Innovation remains paramount for competitive differentiation, with manufacturers developing original intellectual property, securing franchise licenses, and exploring crowdfunding platforms for niche product development. Buffalo Games’ expansion strategies and geographic market penetration demonstrate approaches balancing brand portfolio development with distribution channel optimization. The market accommodates both mass-market producers and specialized developers serving enthusiast segments, creating diverse competitive dynamics that support innovation and consumer choice through continued evolution toward 2032.

Read More Research Reports:

Online Gaming Market Size, Share & Industry Analysis

Skill Gaming Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()