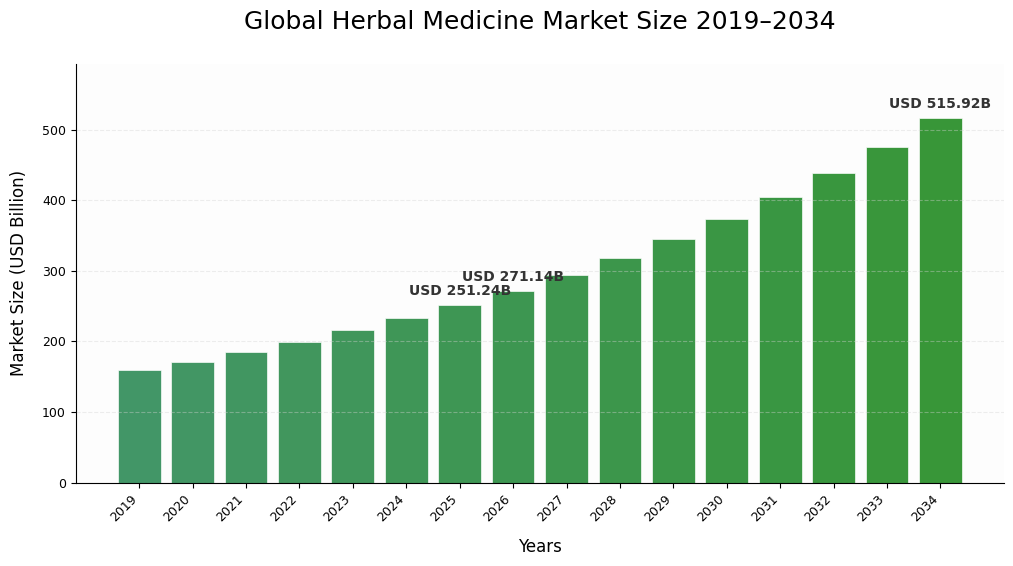

Herbal Medicine Market Size to Reach USD 515.92 Billion by 2034 from USD 271.14 Billion in 2026

NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ — The global herbal medicine market demonstrated substantial value at USD 251.24 billion during 2025. Market projections indicate expansion to USD 271.14 billion in 2026, with forecasts suggesting the sector will achieve USD 515.92 billion by 2034. This represents a compound annual growth rate of 8.37% throughout the forecast timeframe. Regional analysis reveals Europe commanding a dominant position with 44.29% market share in 2025.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/herbal-medicine-market-106320

Market Dynamics and Growth Drivers

According to the World Health Organization, approximately 10 to 50 percent of populations in developed countries use herbal medicine regularly in various forms. Over 80 percent of the global population relies partly on traditional medicine, reinforcing sustained baseline demand across regions. The primary attraction lies in better immunity profiles compared to synthetic drugs. In developing countries including China, Japan, India, Vietnam, South Africa, and Bangladesh, herbal medicines frequently represent the only affordable and available treatment option.

The market benefits from regulatory recognition of herbal products in major economies, increasing clinical validation of herbal remedies, and expanding distribution through pharmacies, hospitals, and digital health platforms. Consumers primarily select these medicines to treat cough, cold, gastrointestinal disorders, and painful conditions including joint pain, rheumatic diseases, and stiffness.

High demand for natural medicines from developing countries offers promising opportunities. Herbal medicines constitute a vital component of medical treatment in many developing nations, where they are used for almost all minor ailments. In developing and lower-income countries, visits to trained doctors or pharmacists are typically rare and reserved for life-threatening disorders. As most developing economies maintain minimal regulations regarding herb usage as medicines, the sector may expand at a robust pace.

Market Segmentation Analysis

Application Categories

The pharmaceutical and nutraceutical segment commanded the largest market share, attributed to high demand for herbal ingredients from dietary supplement manufacturers. Consumers are shifting their preference from synthetic or chemical-based medicines to herbal-based alternatives, considering their long-term health impact. Herbal protein powders and anti-aging products represent popular categories in the dietary supplement and nutraceutical sector.

The personal care and beauty products segment demonstrates the fastest anticipated growth, expanding at a CAGR of 9.16 percent, supported by rising demand for botanical cosmetics, herbal skincare, and clean-label beauty products. The segment accounted for 24.53 percent of total market share in 2026. The cosmetics industry offers promising prospects for natural ingredient exporters from developing countries. There is rising demand within the cosmetics sector, driven by consumers’ increased awareness and companies’ efforts to integrate natural herbal alternatives instead of synthetic ingredients.

Product Form Analysis

The powder segment led the global market with valuation at USD 118.6 billion in 2025, accounting for 47.2 percent of total global demand. Dominance stems from traditional consumption practices in Asia, ease of formulation, and widespread use in decoctions and herbal blends. The segment projects growth at a CAGR of 8.44 percent.

The liquid and gel segment anticipates rising at a CAGR of 8.86 percent, supported by faster absorption rates, pediatric and geriatric suitability, and increasing use in syrups, tinctures, and topical formulations. The segment represented 35.11 percent of total market share in 2026.

Distribution Channel Dynamics

Retail pharmacies and drug stores dominated the market with valuation at USD 99.3 billion in 2025, representing 39.5 percent of global sales. Strong physician trust, over-the-counter availability, and consumer familiarity support segment leadership. The segment projects growth at a CAGR of 7.19 percent.

The e-pharmacies and online platforms segment witnesses the fastest expansion, driven by digital health adoption, home delivery services, and cross-border herbal product sales, significantly outpacing traditional channels during the forecast period.

Regional Market Performance

Europe accounted for USD 111.27 billion in 2025, representing 44.29 percent of global market value, projecting growth at a CAGR of 7.79 percent. Growth is supported by strong herbal supplement penetration, regulatory approvals for traditional herbal medicinal products, and demand from an aging population. Europe boasts the world’s largest cosmetics market, presenting promising opportunities. Germany leads Europe with valuation at USD 21.16 billion in 2026, driven by adoption of phytopharmaceuticals and physician-prescribed herbal medicines. The United Kingdom market valued approximately USD 16.02 billion in 2026.

North America valued at USD 35.2 billion in 2025, accounting for 13.99 percent of global market share, projects the fastest regional CAGR of 8.18 percent from 2026 to 2034. The United States accounted for 63.15 percent of regional demand, valued approximately USD 23.91 billion in 2026, supported by dietary supplement consumption and integrative medicine practices.

Asia Pacific demonstrates significant growth potential, valued at USD 84.4 billion in 2025, accounting for 33.6 percent of global market share. The region projects growth at a CAGR of 9.36 percent, driven by strong cultural integration of traditional medicine systems, large population base, and extensive raw material availability. China represented the largest market globally, valued approximately USD 19.5 billion in 2025, supported by institutionalized Traditional Chinese Medicine usage, government backing, and hospital integrations. India’s market valued approximately USD 7.55 billion in 2026, driven by Ayurveda, rising nutraceutical exports, and increasing demand for preventive healthcare.

Press for an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/herbal-medicine-market-106320

Market Challenges and Opportunities

The sector faces regulatory headwinds due to increasingly stringent guidelines governing herbal raw material use in cosmetic formulations, particularly in developed economies. Regulatory authorities emphasize consumer safety, toxicological validation, traceability, and sustainability, raising compliance costs and lengthening product approval timelines. As of 2023, the European Union restricted or prohibited over 1,600 cosmetic ingredients, including multiple plant-derived substances such as certain essential oils and botanicals.

However, the cosmetics industry offers promising prospects for exporters of natural ingredients. Rising demand for natural ingredients within the cosmetics sector, driven by consumer awareness and company efforts to integrate natural alternatives, persists. Strong demand for beauty products, personal care, and toiletries without harmful chemicals drives market growth.

Read More Research Reports:

Digital Health Market Size, Share & Industry Analysis

Cosmetics Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()